Table of Contents

- Stock Market Circuit Breakers: How They Work : NPR

- Stock Market Trading Suspension History - STOCKOC

- How Do Stock Exchange Circuit Breakers Work? - Equities.com

- Circuit breaker जिसका इस्तेमाल भारतीय stock market में 12 साल बाद किया ...

- What Is a Circuit Breaker in the Stock Market? How Is it Triggered ...

- Stocks Open Down 8% Triggering Another Circuit Breaker - YouTube

- Circuit Breaker Market to Register a CAGR of 6.97% till 2026; Rural ...

- Circuit Breakers: Trading on The Stock Market Halts

- What Is Circuit Breaker In Stock Market - YouTube

- What is a Circuit breaker in the Stock Market & Its Trigger Limit

What are Stock Market Circuit Breakers?

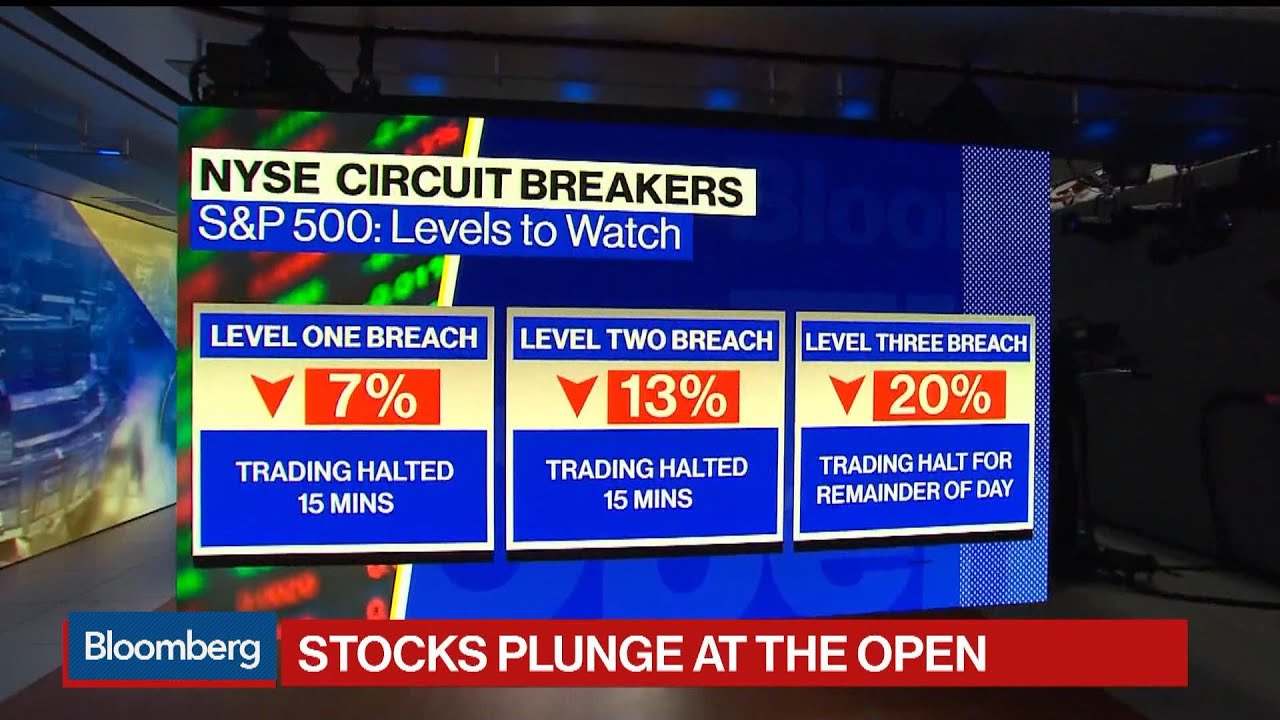

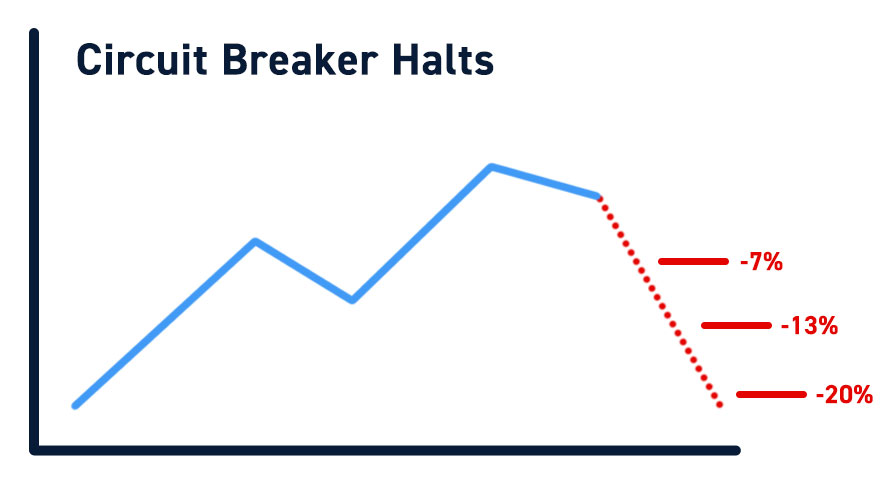

How do Stock Market Circuit Breakers Work?

Significance of Stock Market Circuit Breakers

Stock market circuit breakers play a crucial role in maintaining market stability and preventing extreme price swings. By pausing trading activity, circuit breakers: Prevent market crashes: By halting trading, circuit breakers prevent a rapid decline in stock prices, which can lead to a market crash. Allow investors to reassess: Circuit breakers give investors time to reassess their positions and make informed decisions, rather than reacting impulsively to market volatility. Maintain market order: Circuit breakers help maintain market order by preventing excessive price movements and promoting a more stable trading environment. According to Charles Schwab, a leading online brokerage firm, circuit breakers are an essential component of the stock market's infrastructure. "Circuit breakers are designed to provide a cooling-off period during times of extreme market volatility, allowing investors to reassess their positions and make informed decisions," says a spokesperson for Charles Schwab. In conclusion, stock market circuit breakers are an essential mechanism for maintaining market stability and preventing extreme price swings. By understanding how circuit breakers work and their significance in the stock market, investors can better navigate the markets and make informed decisions. Whether you're a seasoned investor or just starting out, it's essential to stay informed about the stock market and its mechanisms, including circuit breakers. With the help of reputable online brokerage firms like Charles Schwab, investors can stay up-to-date with market developments and make the most of their investment opportunities.This article is for general information purposes only and is not intended to be taken as investment advice. Investors should always consult with a financial advisor before making investment decisions.