Table of Contents

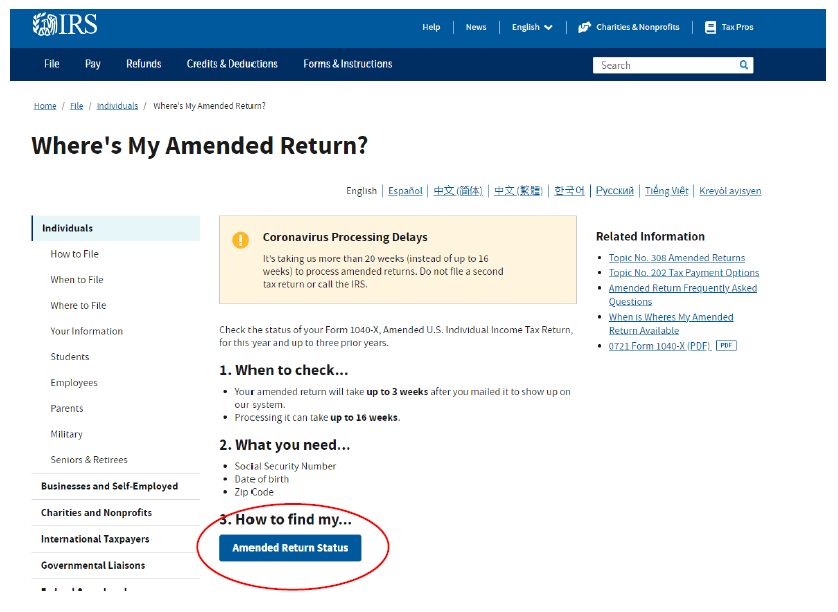

- Tips and Tricks to Navigating the IRS.gov Website - Thompson Greenspon CPA

- IRS relaunches Get My Payment portal for 2nd coronavirus stimulus

- Fillable Online There are two modes of payment of direct taxes (i ...

- How to Make IRS Payments for Your Taxes - Tax Defense Network

- IRS Payments? : r/TheTpGentleman

- Optimizing Billing Processes: Saving Time, Boosting Revenue

- How to View Your IRS Tax Payments Online • Countless

- IRS Payment Plan Specialists Gilbert – Tax Debt Advisors

- Irs 2024 Payment Schedule - Kania Marissa

- Secure Payment Methods for Importing from China to Malaysia

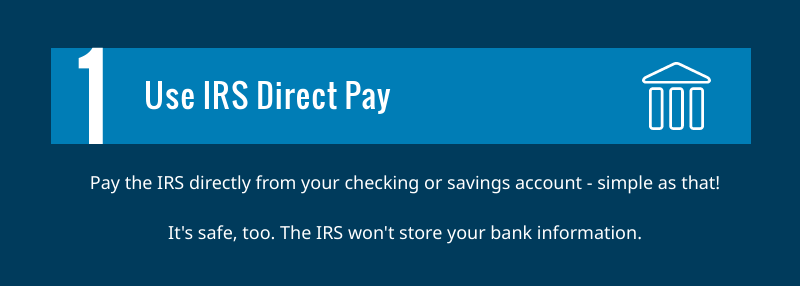

What is Direct Pay?

Benefits of Using Direct Pay with Your Bank Account

How to Use Direct Pay with Your Bank Account

To use Direct Pay with your bank account, follow these simple steps: 1. Visit the IRS Website: Go to irs.gov/payments and select "Direct Pay" from the payment options. 2. Enter Your Information: Provide your name, address, and tax information, such as your Social Security number or Employer Identification Number (EIN). 3. Choose Your Payment Type: Select the type of tax you're paying, such as income tax or estimated tax. 4. Enter Your Bank Account Information: Provide your bank account number and routing number. 5. Verify Your Information: Review your payment details to ensure accuracy. 6. Submit Your Payment: Click "Submit" to complete the payment process.

Additional Tips and Reminders

Make sure to have your bank account information and tax details ready before starting the payment process. You can schedule payments up to 365 days in advance. Direct Pay is available for individual and business tax payments. You can also use Direct Pay to make payments for prior year tax liabilities. In conclusion, using Direct Pay with your bank account is a convenient, secure, and free way to pay your federal taxes. By following the simple steps outlined above, you can streamline your tax payment process and avoid the hassle of writing checks or using credit cards. Visit the IRS website today to take advantage of this useful service and make your tax payments with ease.For more information on Direct Pay and other IRS payment options, visit irs.gov or call the IRS at 1-800-829-1040.